Health Advocate Taps Industry Expert Alyssa Scott, PhD, to Lead Next Generation Analytics Products and Services

Health Advocate announced today that Alyssa Scott has joined the organization as Senior Vice President, Healthcare Analytics, leading the organization's Engagement Analytics division.

‘I got a colonoscopy at 28’

Colorectal cancer rates in people under 55 are rising according to a new report from the American Cancer Society.

Health Advocate Recognized for Excellence in Service by National Customer Service Association

Health Advocate announced today that it has been selected as Service Organization of the Year in the 2023 National Customer Service Association (NCSA) Service All-Star Awards.

Compassionate Support During a Difficult Time

When Jason Boone’s car was hit by a drunk driver in 2021, the former pro-athlete was unsure how to begin navigating next steps, so he reached out to Health Advocate

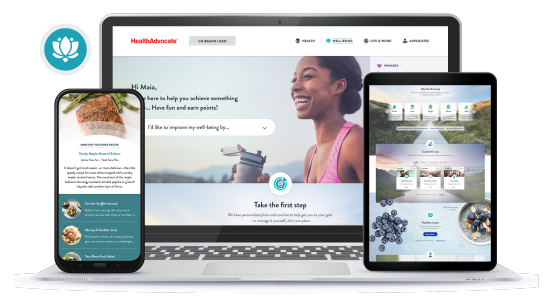

Health Advocate Launches Reimagined Be True Well-Being Program

Health Advocate announced today the launch of its all-new Be True Well-Being program, a total well-being experience.

‘Tis the Season for Employers to Address Skyrocketing Stress

Levels of burnout and anxiety are already high this year as an ongoing pandemic, social unrest and other stressors continue to take their toll on employees' emotional well-being. Now comes

Health Advocate Wins Silver in Best in Biz Awards 2022

Health Advocate has been selected as a Silver winner in the Most Customer Friendly Company of the Year in the Best in Biz Awards.

Health Advocate Welcomes Jeff Cordell as President and CEO, Amplifying Innovation and Growth

Health Advocate announced today that Jeff Cordell has joined the organization as president and chief executive officer.

How data analytics can enhance EAP support

The emerging use of artificial intelligence techniques like natural language processing in data analytics can help HR analyze available information more effectively.